Know What You Own and Why You Own It

27 February 2020

For a prolonged period of time now funds within the IA Targeted Absolute Return sector have come in for some abuse, normally related to their performance, or lack of it. In some respects this has been warranted, with some funds failing to provide the protection on the downside which they perceived to offer, whilst offering very little upside, if any at all, when markets were rising. Ultimately, fund allocators become disillusioned.

As with many of the Investment Association (IA) sectors however there are many different types of strategies within the Targeted Absolute Return sector and you really have to get under the bonnet to find what you are looking for.

Within the MI Diversified Strategy Fund we allocate to absolute return funds, predominantly those who run a long/short equity strategy. Within the current stable we allocate to funds which run such strategies across UK, European, US and Japanese equities. The idea is that we can reduce our exposure to long only equity funds when we believe it appropriate, whilst still maintaining exposure to the asset class but with significantly less market risk, or beta. This can help protect the overall portfolio in time of volatility and drawdown.

Before allocating to such funds we are very careful to understand the investment philosophy, the investment process and historic and typical positioning. The last thing we want to see is a fund such as these performing in the way as a long only equity fund. To this end, we always look to allocate to a currency hedged share class as we don't want a surprising currency move unwinding all of the good work the manager has done in terms of stock selection.

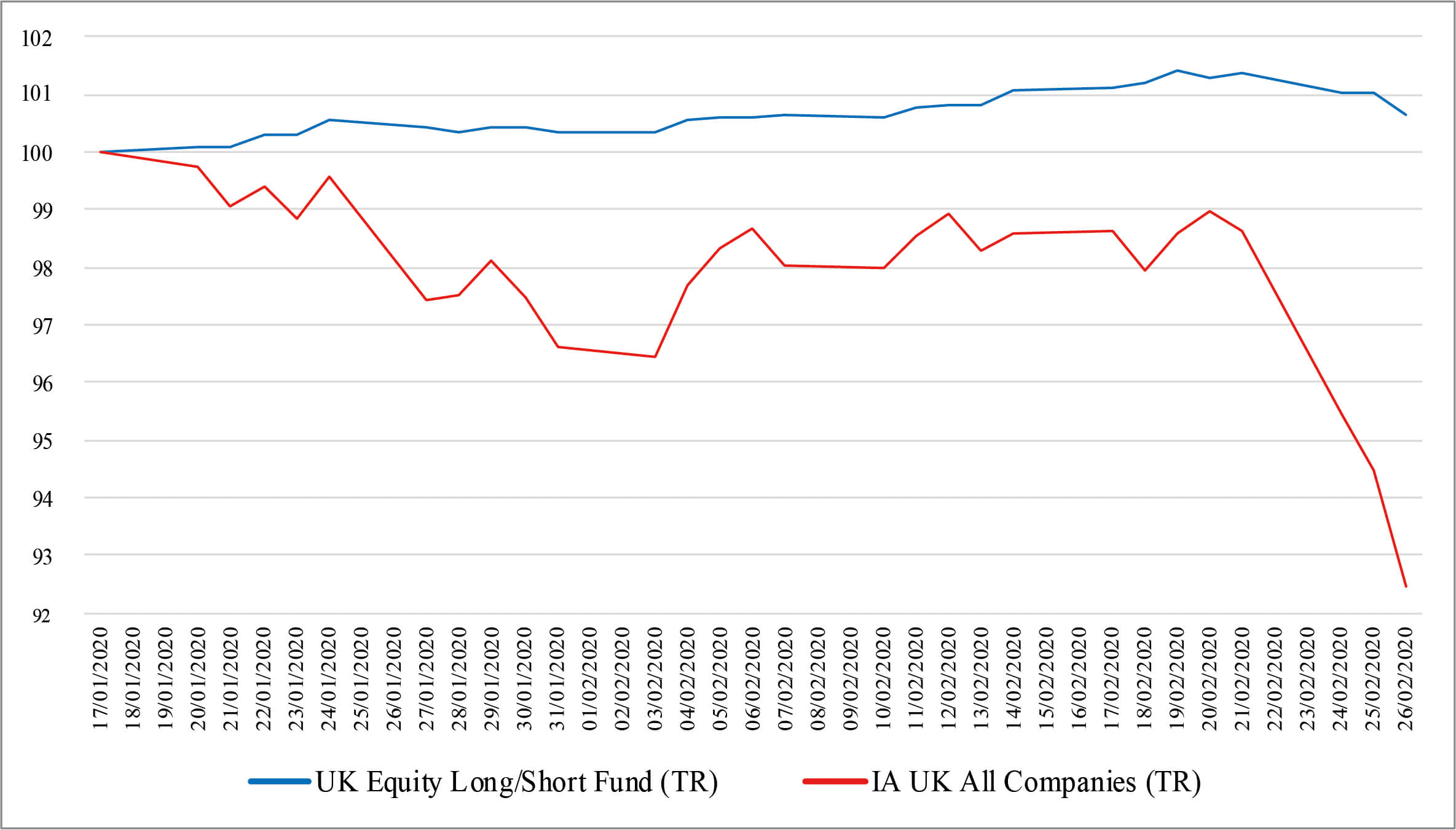

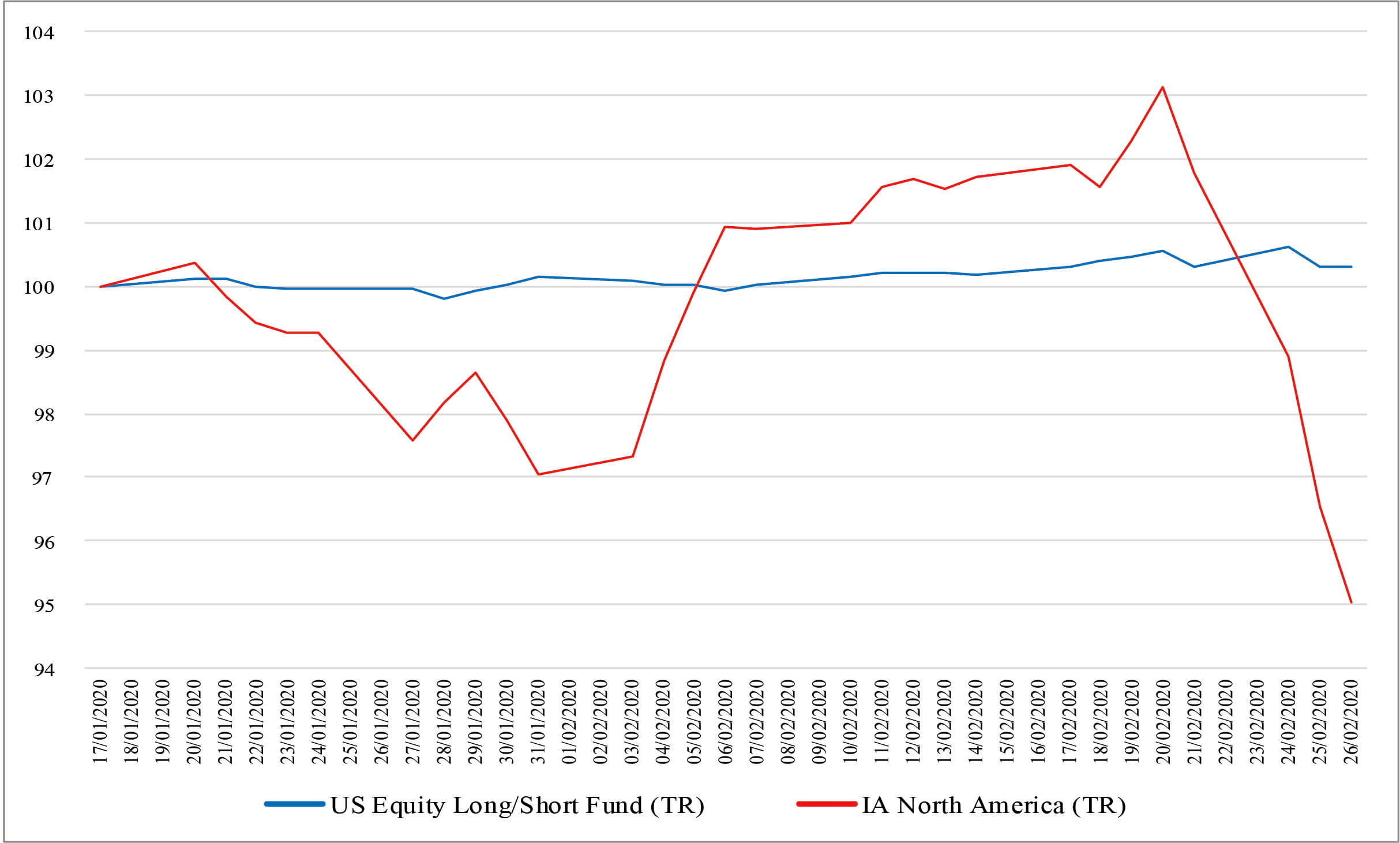

So how has the strategy worked of late Well since mid-January and the coronavirus outbreak it has worked very well in terms of offering protection against drawdown. Below we show how our UK and US choice have performed, on a total return basis, relative to the IA UK All Companies and IA North America sectors, being representative of long only equity funds.

Source: FE Analytics, Bid-Bid, Total Return

Source: FE Analytics, Bid-Bid, Total Return

A similar profile is also seen for our European and Japanese long/short equity selection.

There will be a time when we reduce our allocation to these funds and rotate the proceeds back into long only equities, but for now, whilst the heightened risk of volatility and drawdown prevails, we remain happy with our course.

Looking under the bonnet of both the IA sectors and funds within them always has and always will be important no matter what the market conditions, 'know what you own and why you own it'.

This article is for information purposes only and should not be construed as advice.

We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested.

Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future.

The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK.

We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.