Ear to the ground

21 October 2022

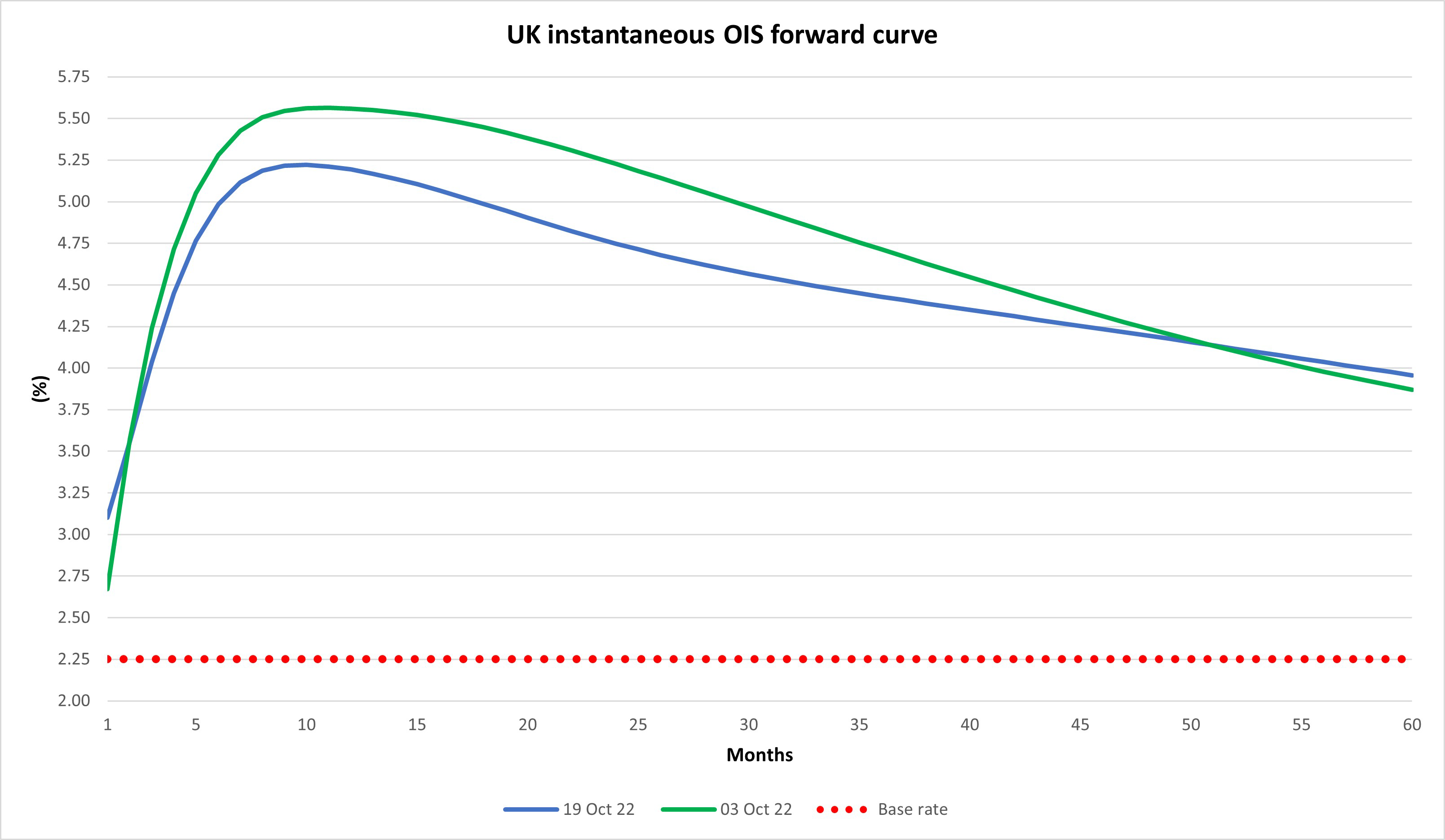

It is fair to conclude that this week has again been dominated by politics, with the resignation of Liz Truss stealing the headlines. This has been very well publicised in great depth and therefore we will leave it there. From an economic perspective in the UK, this week we saw the release of CPI to September. This came in at 10.1%. This was slightly ahead of the consensus forecast of 10% and given this did little to unnerve markets. The Bank of England are next due to meet on the 3rd November. By reference to the latest Bank of England OIS forward curve, a 0.75% hike in rates is expected, which, if it is delivered, will take the base rate to 3%. This is higher than the predictions made at the start of the month, as we can see below.

The recent appointment of Jeremy Hunt however, and the reversal of many of the fiscal announcement proposals made by Kwarteng, has lowered the expectation for the terminal rate. A forecast of 5.25% is now being made which compares to the previous level of 5.5%. In signs that the cost of living is continuing to bite we saw UK retail sales for the 12 months to the end of September come in weaker than expected at -6.9% versus a consensus forecast of -5%.

In the US meanwhile the latest implied terminal interest rate is around the 5% mark, with the next change expected to take it from the 3%-3.25% range to 3.75%-4% range. Whilst more rate hikes are forecast there is there the belief, or perhaps hope, that the peak in inflation in the US is already upon us, or soon will be. Whilst we continue to see wage and rent increases, these are very much seen as lagging indicators.

In times such as these you will often find market commentators and analysts looking for trends which have stood the test of time. The latest from BCA Research shows that over time CPI inflation has held a close relationship, or followed a very close trajectory, with the ISM Manufacturing Prices Paid index, advanced by 3 months. The two however have very much got out of kilter of late, with CPI continuing its upward path whilst the ISM index has fallen quite sharply. If the previously close trend were to be restored this could imply that US CPI has peaked and a downward leg should, or perhaps it is better to say could, be expected. Could the ISM Manufacturing Prices Paid index be a leading indicator for CPI? Time will tell.

Speaking of leading indicators, the US Conference Board have published their latest set of data. This latest release certainly suggests that the US economy is heading for recession, although some would argue that they are already there. The US economy has already posted two consecutive quarters of economic growth which, technically speaking, is a recession. For now however, giving reasons of a strong labour market for example, the authorities refuse to call it one. Research by TheMacroCompass takes the information back even further. On each occasion that the same indicator drops below zero and stays there for two or more months, their research shows that the US then endures a recession. It is now below zero. How long has the US got before it has to declare that it is official!

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.