Ear to the ground

21 July 2023

I wonder what we are going to talk about this week? That’s right, you guessed it, inflation. And rightly so. The latest release of UK inflation data caught the market, forecasters and investors on the hop this week. The consumer price index (CPI) had been expected to post a year on year increase of 8.2% to June as per consensus forecast. The actual figure however came in at 7.9%, also being much lower than the May figure of 8.7%. The main driver behind the fall was a fall in the cost of fuel. Core inflation was also lower than expected, coming in 6.9% versus expectations of 7.1%.

Whilst the level of inflation is clearly moving in the right direction, the absolute level still remains high and well above the Bank of England target. So why the excitement seen in both equity and bond markets? Well, firstly, whether the rate is high or not, the direction was in the right way and below forecast. Where we feel the market also took comfort from was that when you look at the component sectors within CPI we can see that only two saw an increase in their annual inflation rate, being clothing & footwear and communications. There was even a fall in food & non-alcoholic beverages, although at 17.3% the annual rate of inflation is clearly still far too high for comfort.

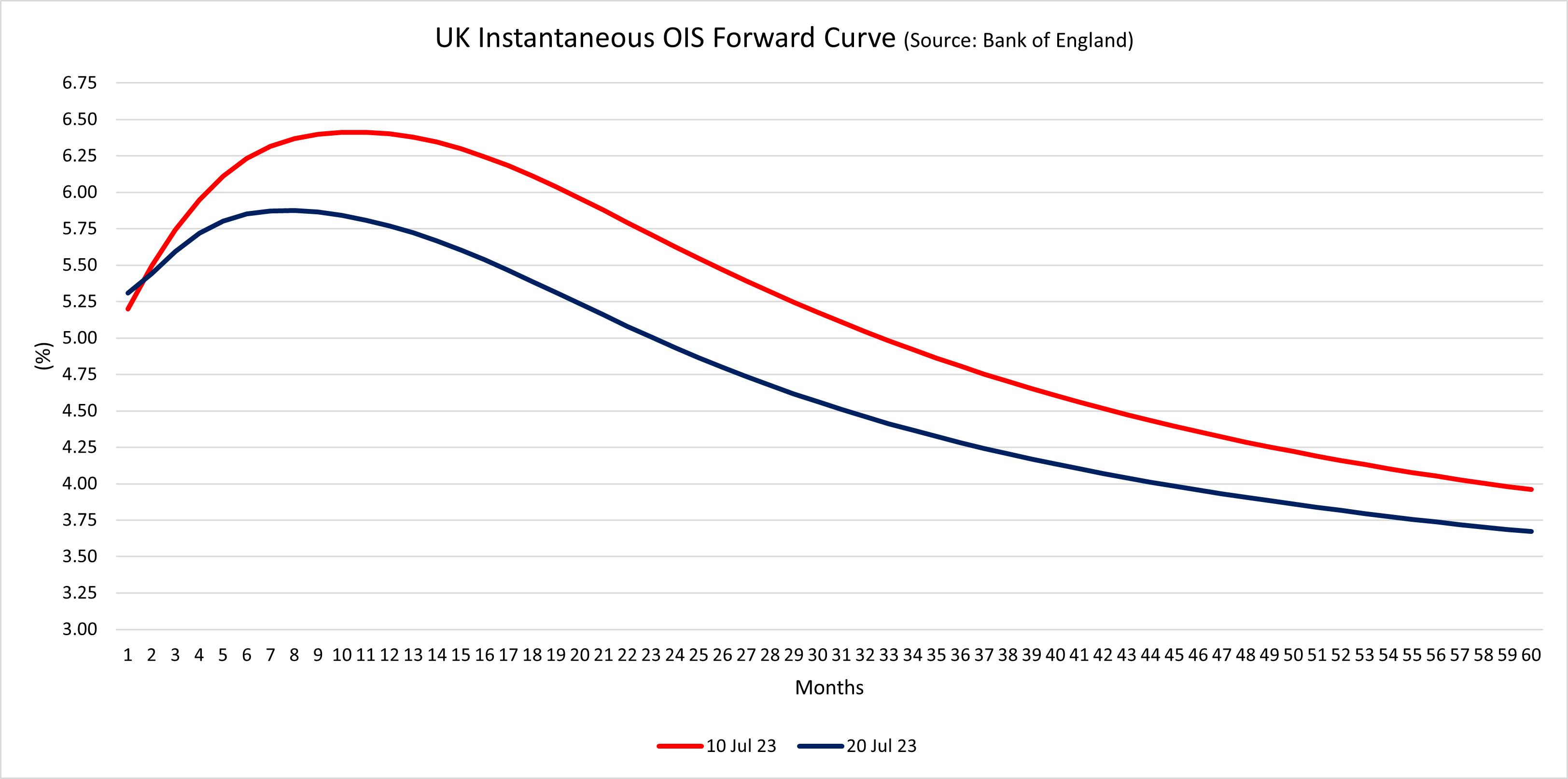

The change in UK interest rate expectations, as expressed by overnight index swaps, has been noticeable. On the 10th July the market was pricing that the base rate could be as high as 6.5% in 12 months’ time, 1.5% above the current level of 5%. That 12 month forecast is now suggesting a rate of 5.75%, likely achieved through three 0.25% hikes. We could reach 6% before then, but even then the terminal base rate which we are expected to see is now lower. Now, as always, it is necessary to place many caveats over this. Markets are moving very sharply to surprise data at present and as we have seen already, including this latest inflation print, things are proving somewhat hard to estimate at present. Or should that be guesstimate??

The impact on UK assets was positive, some more than others. It will be no surprise to hear that gilts performed well, up over 2% on a total return basis between the 17th and 19th of July. Large cap equities were up almost 2.5% over the same period. The real winners were mid-cap stocks however, up over 5.5%. The excitement here was that a lower terminal interest rate this cycle could mean that lesser brakes are applied to the UK economy. Therefore, companies whose earnings are more geared to the UK economy could report better earnings than initial expectations moving forward.

There remains a lot for not just the UK but also the global economy to muddle through, but if this week has taught us anything, it is that a diversified portfolio remains appropriate in this environment.

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.