Ear to the ground

21 February 2025

It has been rather a busy week from an economic date release perspective. In the UK, first up we had employment data. Whilst a pick up in wage growth was forecast, average earnings including bonuses posted an increase of 6%. This was higher than the previous reading of 5.5% and the consensus forecast of 5.9%.

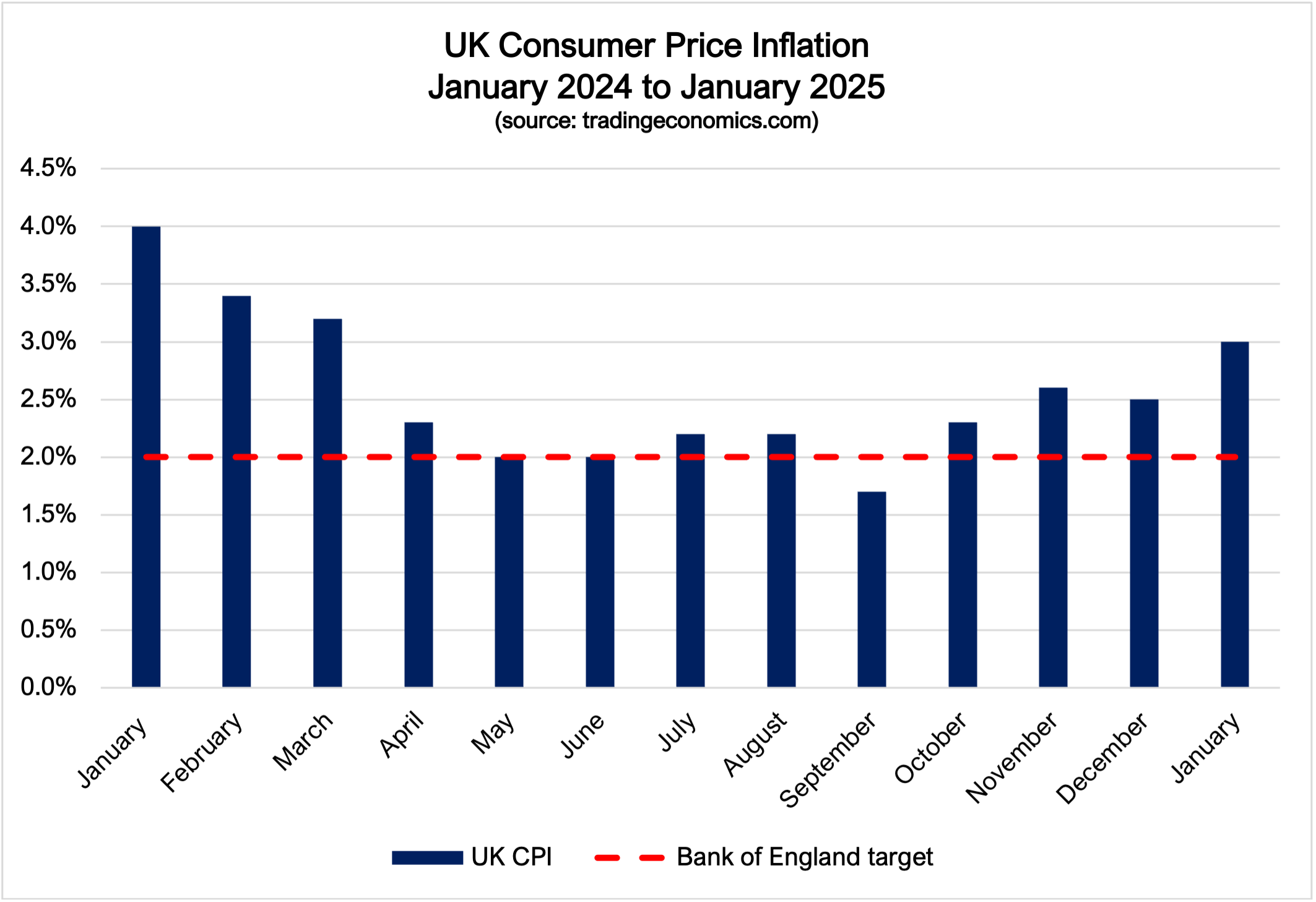

The following day we also saw the release of consumer price inflation data, with another surprise to the upside. A rate of 2.8% had been forecast, above the previous month’s reading of 2.5%. Instead, however, we saw a reading of 3%. Services inflation was a key driver, which rose to 5% from 4.4% recorded the previous month.

Whilst this higher rate perhaps suggests that the ability of the Bank of England to reduce interest rates is curtailed further, they will at the same time be perhaps concerned that the risks of stagflation are building. Stagflation is when we see a higher rate of inflation but a slow rate of economic growth.

Purchasing managers indices (PMI) meanwhile continue to illustrate the two speed economy which we have in the UK. The PMI for the manufacturing sector posted a larger than expected fall and continues to indicate that it is in a state of contraction. The PMI for the services sector meanwhile was above last month’s reading and consensus forecast, continuing to indicate a state of expansion.

In Japan the latest reported inflation rate was higher than previous. For the 12 months to January we saw a reading of 4%, up from 3.6%. An increase in food prices was a key driver here, but even the core inflation rate, which excludes the more volatile items of food and energy, rose to 3.2% from 3%. With fourth quarter economic growth coming in stronger than expected, it questions how long the Bank of Japan can maintain an interest rate of only 0.5% before having to hike again.

Finally, in the US all eyes were focussed on the release of the minutes from the last interest rate setting meeting of the Federal Reserve. These highlighted that the policymakers accepted there is a high level of uncertainty at the moment which requires a cautious approach towards monetary policy. They suggested that monetary policy could remain restrictive should inflation remain at an elevated level and economic growth robust. At the same time, however, they also acknowledged that rates could be eased at a quicker rate than expected, if inflation were to return to 2% sooner than anticipated. So, nothing much really new there; back to watching the data!

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.