Ear to the ground

17 January 2025

“Oh no they won’t, oh yes they will…”

As we reach mid-January you could be forgiven for thinking that this pantomime phrase would now be redundant. When it comes to whether central banks, particularly the Bank of England, will cut interest rates or not, apparently not. In the UK this week we saw the release of the eagerly awaited inflation figures for December. Whilst a lagging indicator they remain the centre of attention. For those hoping for an interest rate cut by the Bank of England there was good news here. Consumer price inflation took a surprising dip, posting a year on year rise of 2.5%. This was lower than the November reading and the consensus forecast of 2.6%.

Core inflation also surprised to the downside, with a rate posted of 3.2%, well below the November reading of 3.5% and the consensus forecast of 3.4%. A fall in inflation within the service sector was the key driver here, where up until now sticky inflation has been evident. Accompanying this was the release of weaker than expected retail sales data for December. Month on month a decline of 0.3% was recorded compared to a consensus forecast increase of 0.4%. The year on year rate of growth was therefore lower than expected, at 3.6% versus an expected 4.2%. GDP figures meanwhile showed that the economy grew 0.1% in November, 1.0% year on year.

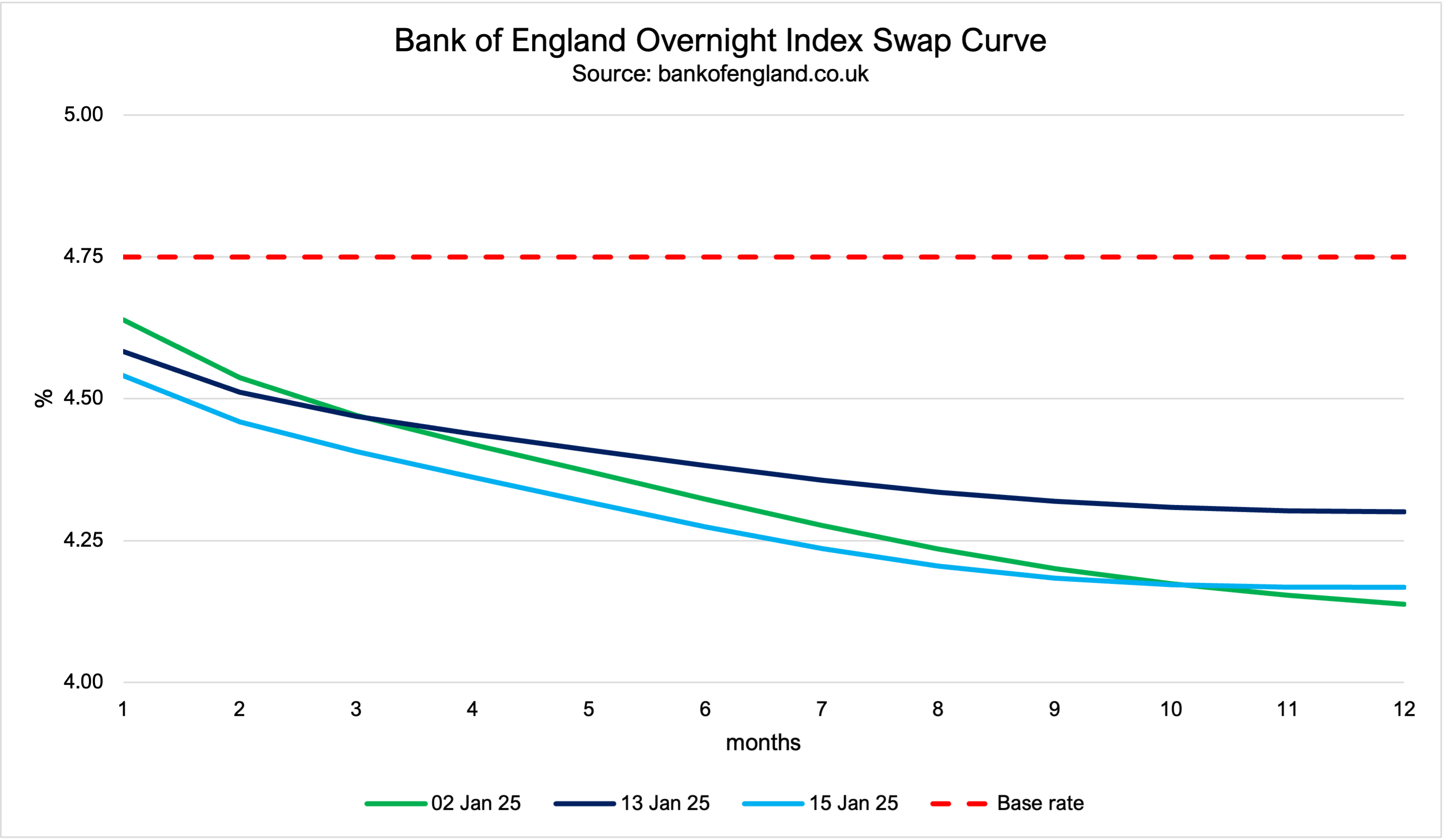

As a consequence we have seen some fluctuation in interest rate expectations, as indicated by the Bank of England Overnight Index Swap (OIS) curve. Concern over the budget deficit and the potential for a pick-up in inflation had initially seen a reduction in expectations for interest rate cuts in the first couple of weeks of 2025. Indeed, just before this data was released there was an expectation that only two cuts may be seen. The market is now edging back towards the potential for three. The expectation that the first cut will happen in the next week or so has also increased.

The reaction from UK assets has been clear to see. After reaching a disconcerting closing level for some of 4.885% on Monday, the UK 10-Year Gilt yield has retraced to 4.6835% at the time of writing. The FTSE 100 hovers around all-time highs, almost 3.3% higher than last Friday’s close, whilst the more economically sensitive FTSE 250 mid-cap index is up over 4.3%.

The year to date has certainly proven to be a period of RO-RO, risk off-risk on. More to come?

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.