Ear to the ground

07 March 2023

With February now drawn to a close, we provide a summary of market movements for the month rather than the usual Fund Focus, which will return next week.

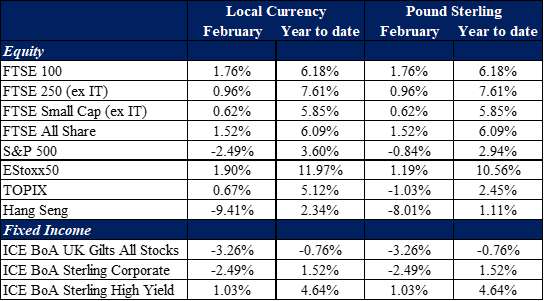

As we can see from the chart above, it was a mixed month for both equities and bonds. Focusing on equities first, the range of returns for the month was quite large in local currency terms. The Hang Seng was the weakest performer of those shown. Although the Chinese economy continues to reopen the market fell sharply. Indeed, the upcoming China National People’s Congress is expected to reveal further policy support on economic growth. There has been little news on China, other than rumblings from the US on the way US companies do business there, but that has been the case for some time now, so nothing new there. Losses are perhaps due to a bout of profit taking although the possibility of higher interest rates in the US as inflation remains a concern can’t be ruled out. The Hang Seng has given back a large proportion of its gains for 2023 although still remains in positive territory.

US equities were also negative on the month, although they also remain positive for the year to date. It was large cap stocks which led the market lower, although the Russell 2000 was also in negative territory. With inflation proving more stubborn than the market had anticipated the expectation of a Fed pivot were all but removed, pushing bond yields higher and proving something of a headwind for stocks too.

The UK, Europe and Japan all ended the month in positive territory. In the UK it was large cap stocks which led the way, although positive returns were also seen for mid and small cap counterparts. Oils and energy related stocks continued to be strong performers. Although we have seen a fall in oil and energy prices, the level is still at a profitable level for these companies. Centrica also posted gains for the month, with profits beating forecasts leading to the announcement of a share buyback programme. Whilst many banks posted strong earnings numbers, with the exception of perhaps Barclays, share prices were generally lower as some spread some caution on future earnings, with NatWest for example commenting that the earnings boost from UK interest rate rises may have peaked.

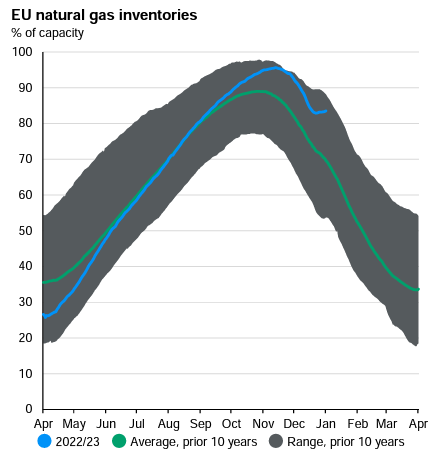

European shares continued to push higher as concerns over the scale of the economic slowdown continued to subside. Although a slowdown is expected, a soft landing is now anticipated, despite rhetoric from the ECB that they are by no means ready to stop with their rate hiking. The main reason for the pick-up in confidence can be very much put down to one chart, shown below.

As I am sure you will remember, the largest concern for the EU was energy supply. Heading into the winter however the region managed to fill the storage tanks close to historically high levels. A warm winter meanwhile has meant that usage has been less and the amount in storage still for this time of year remains well above the prior 10 year average and remains close to historic highs.

Inflation expectations clearly had an impact on equity markets and the story wasn’t any different in fixed income markets either. The UK fixed income market took much of its direction from the US, where there was a sharp increase in interest rate expectations from investors. Coming into the month the market had expected the US Federeral Reserve to get no where near their latest median dot plot forecast in terms of terminal rate. Furthermore, they also expected that they would be cutting interest rates into year end as they pivoted from their current tightening stance.

Fast forward to the month end however and opinions have changed quite dramatically. The market, guided by futures, expects US interest rates to peak above the median dot plot prediction. Even though a cut in rates is still predicted, latest market expectations still leaves interest rates ending the year higher than Fed expectations. As a result of this shift, along with higher expectations for inflation in Europe, UK gilts ended the month lower/yields higher. Investment grade corporate bonds followed the same path, although they did not lose as much ground. High yield meanwhile stood up better, given their lower interest rate sensitivity, higher yield and given that they are more driven by credit.

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.