Coronavirus Update

31 January 2020

The advent of the coronavirus was the catalyst for an increase in volatility within stock markets in January.

At the time of writing there have been over 40,000 cases reported and the death toll has reached a sad to report level of over

1,000.

99% of all cases are in China and 80% of the cases are reportedly quarantined in the Hubei province.

As news of this new virus broke it initially drove equity markets down as investors contemplated the potential impact that such as virus could have on global economic growth. Markets closer to the epicentre of the virus were more severely hit, with the Hang Seng of Hong Kong, for example, falling 9.44% in local currency terms between the 17th and the 31st January. Other markets did not escape, with the South Korean exchange over the same period down 5.85%, the FTSE All Share down 4.71% and S&P 500 down 3.13%, to cover but a few. The Chinese market had an extended close following their New Year celebrations but on the first day of reopening it found itself down almost 8%.

Equity markets historically do not respond well to known unknowns and even less so to unknown unknowns. The coronavirus is certainly the latter, with no one having predicted it's arrival and no-one sure of the future ramification. As highlighted above, they reacted accordingly. In such periods however it is important to reflect on what is known rather than looking to make rash decisions which you may regret later. Market analysts will in such periods typically, in the first instance, look to the past for potential insights into the future.

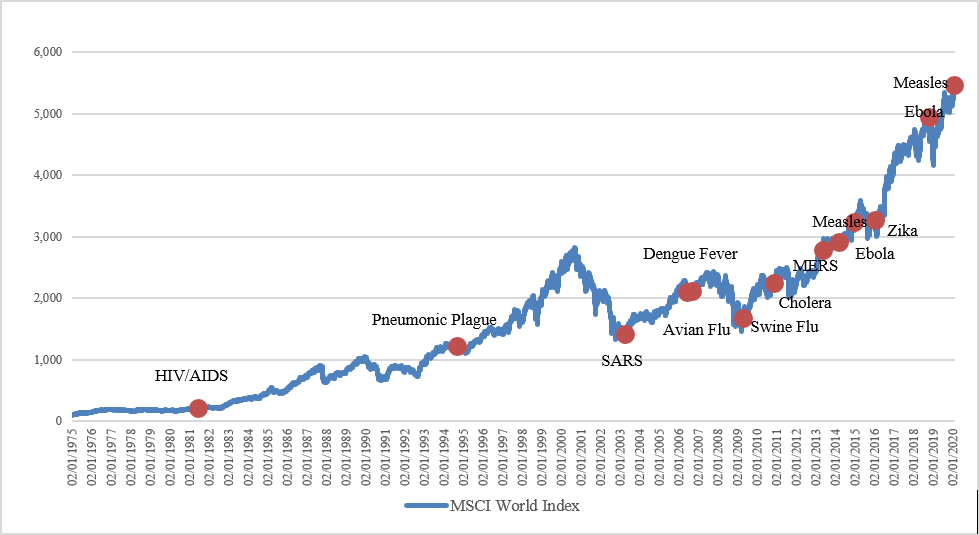

So, what from the past can we draw on in the present day? In the chart below we show the performance of the MSCI World Index since 1970 and on top of this we have overlaid the global epidemics which have occurred over this time period.

Now looking at this chart we think it is safe to say that on a long-term view previous incidents have had little impact on the trajectory of the global stock market. Whilst there has clearly been some long term "bumps in the road", or even perhaps potholes, as we can see there are few, if any instances when these have occurred due to an epidemic.

What charts such as these don't show however is the state of the global economy at the time when such events have occurred. Let us take for example the SARS epidemic which some commentators have been drawing comparison to. Although the first cases were in fact in 2002 it was not reported until April 2003. At this point the global economy was about to enjoy a strong recovery, having been in the doldrums since the late 1990s. This would propel equity markets higher, with the MSCI World Index posting a total return of 17.38% in the ensuing 6 months, the impact of the SARS virus paling into insignificance.

It was a similar story for the swine flu epidemic which was first reported in April 2009. This of course followed the Global Financial Crisis of 2008/9, after which central banks looked to turn around both the global economy and asset prices by launching quantitative easing. In the 6 months post the first reported outbreak the MSCI World Index went on to post a total return of 22.83%, again the impact of the virus proving minimal. Compared to the SARS outbreak however the global economy is in a very difficult place.

Rather than being in an early cycle recovery, this time I don't think anyone would argue that we are late cycle in what has been the longest period of economic expansion in history. The growth rate remains below long-term trend and during 2019 we saw a fall in future expectations, particularly in manufacturing.

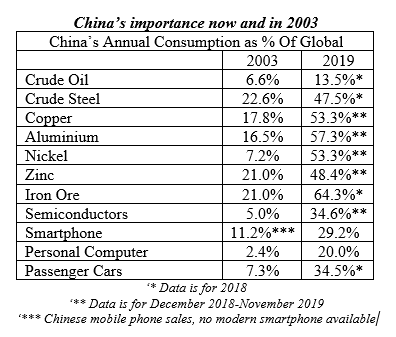

The second most significant change is the impact of China on the global economy. China undoubtedly plays a much larger role than it did in 2003, which we hope to best illustrate in the table shown below.

This list is of course not exhaustive, but the increased influence of the country is clear to see. Data from the International Monetary Fund (IMF) also shows the Chinese economy is now the second largest in the world, it's share of the global economy being 15.5%. When the consumption within an economy the size of China therefore slows, the impact on the global economy is more meaningful. By the same token, whilst China has made substantial moves to move away from being simply an exporting nation and one where the economy is more domestic consumption led, it still remains a significant force in terms of global manufacturing and export. This is not only finished goods but also parts and components which other companies, including those in developed nations, rely upon, playing a significant part in the global supply chain. With most of the Chinese manufacturing sector yet to restart, this is not only having an impact on Chinese companies but also those overseas, with some having to stop manufacturing themselves.

Some market commentators are now forming the opinion that this virus could be the "Black Swan" event which finally tips the global economy into recession. Whilst nothing can be ruled out at this stage, it appears a little premature to call this. We are yet to see how these events are impacting on confidence surveys and it will be a while before we see the flow into economic data. Although the tools at the disposal of central banks are clearly more restricted than they were 10 years ago, we can't rule them out from intervening should they deem it necessary, particularly in China where the state also still maintains significant control.

So, the unknown unknown has now become a known unknown. Equity markets have for now recovered and appear to have taken it in their stride. As the unknowns become more known their future direction will be determined. Either way, we think it is right to expect further volatility along the way.

This article is for information purposes only and should not be construed as advice.

We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested.

Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future.

The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK.

We strongly suggest you seek independent tax advice prior to taking any course of action.

Past performance is not a guide to the future.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.