Ear to the ground

14 February 2025

There was positive news for the UK economy this week, although when reporting data, it is important to remember that most is reflecting on the past. Preliminary figures for fourth quarter growth last year showed that the economy expanded, contrary to the consensus forecast where a contraction was expected. The rate was admittedly small, at 0.1%, but it was growth all the same. This was helped by a stronger than expected December, driven by the services sector. Year on year, a growth rate of 1.4% was recorded.

A key mover on the back of this stronger data has been sterling, including against the US dollar, where it has risen above $1.26. The UK 10 year gilt yield had initially moved up, rising to almost 4.6%, but at the time of writing has fallen back to the 4.5% level.

There was also better news for both industrial and manufacturing production in December, where we saw stronger growth than expected. The former posted a rate of 0.5% against a forecast of 0.2%. Manufacturing production was even better, where growth in the month of 0.7% was seen against an expected contraction of 0.1%. Despite the positive figures the sectors are by no means out of the woods just yet. Year on year both continue to post rates of decline, at -1.9% and -1.4% respectively.

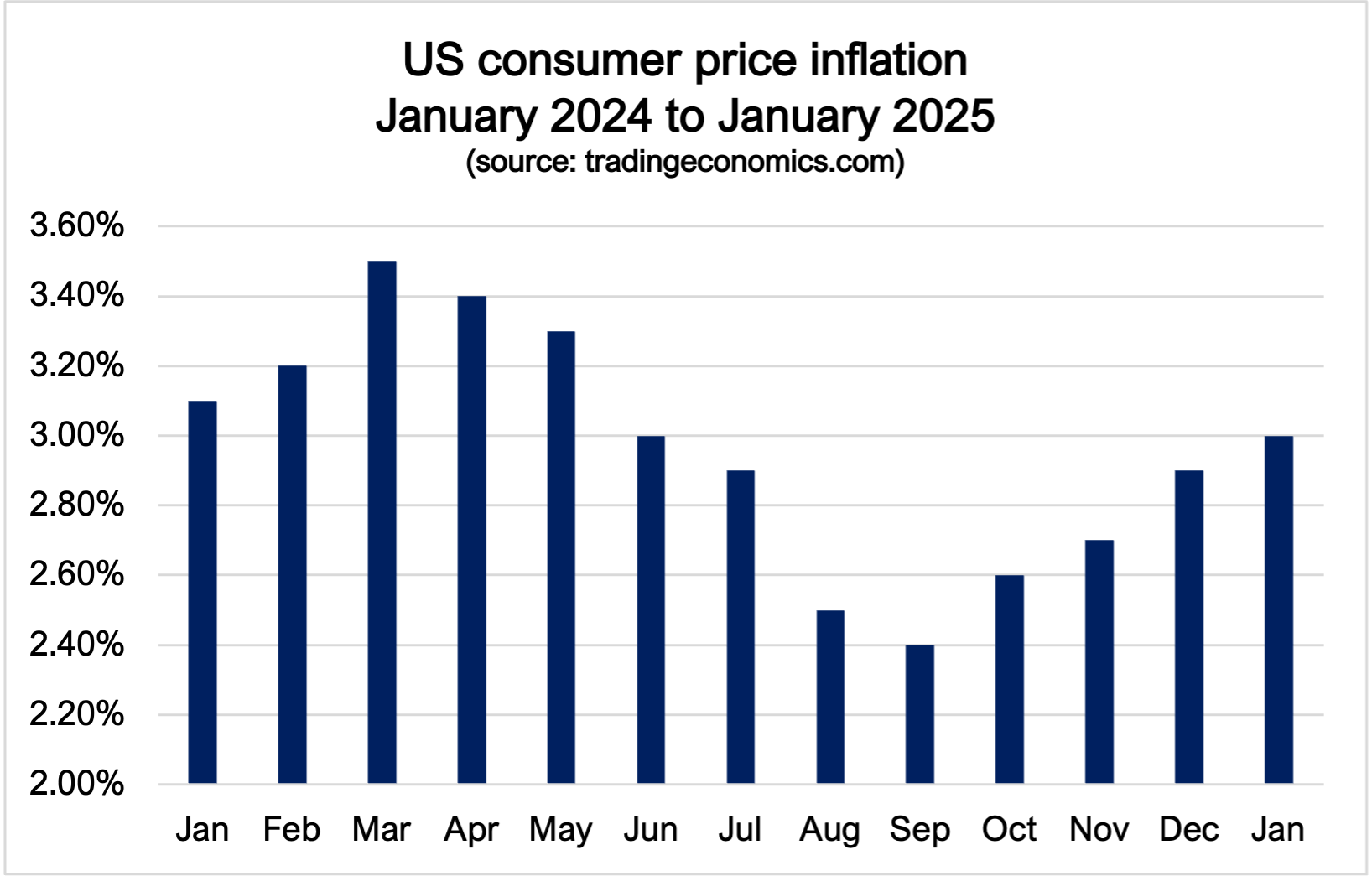

In the US the focus was on inflation data this week, which surprised to the upside. The year on year rate to January increased to 3%, above the December reading of 2.9%. This was the fourth month in a row where it has risen, coming from 2.4% in September last year. There was also a pick up in the core inflation rate, against market expectations of a fall. A rate of 3.3% was recorded, compared to 3.2% in December and a forecast of 3.1%. The data perhaps justifies the decision by the Federal Reserve at their last meeting to keep rates on hold.

For those who believe that interest rates still remain on the higher side, they come far short compared to those in Russia. This week the Bank of Russia held its key rate at a record high of 21%! They noted that inflationary pressures still remain too high and that demand continues to outstrip their domestic supply capabilities. This key rate his risen from a low in this current cycle of 7.5% in 2023.

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested. Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.