Ear to the ground

18 February 2022

In a further sign that certain stocks are priced for perfection we saw another technology stock take a tumble this week when it missed on expectations. This time it was Roblox, the open gaming platform, who on Wednesday saw their share price fall 26.6%. In good news for the company it reported 49.5m daily active users, up 33% from the year earlier period. Fourth quarter revenue missed expectations, coming in at $770m, below the $772m predicted by analysts. The figure which was perhaps responsible for the decline in share price was the wider than expected loss per share at 25 cents per share compared to an expected 13 cents. Whilst this was a very sharp fall, the share price was already some distance below its previous all-time high in November 2021.

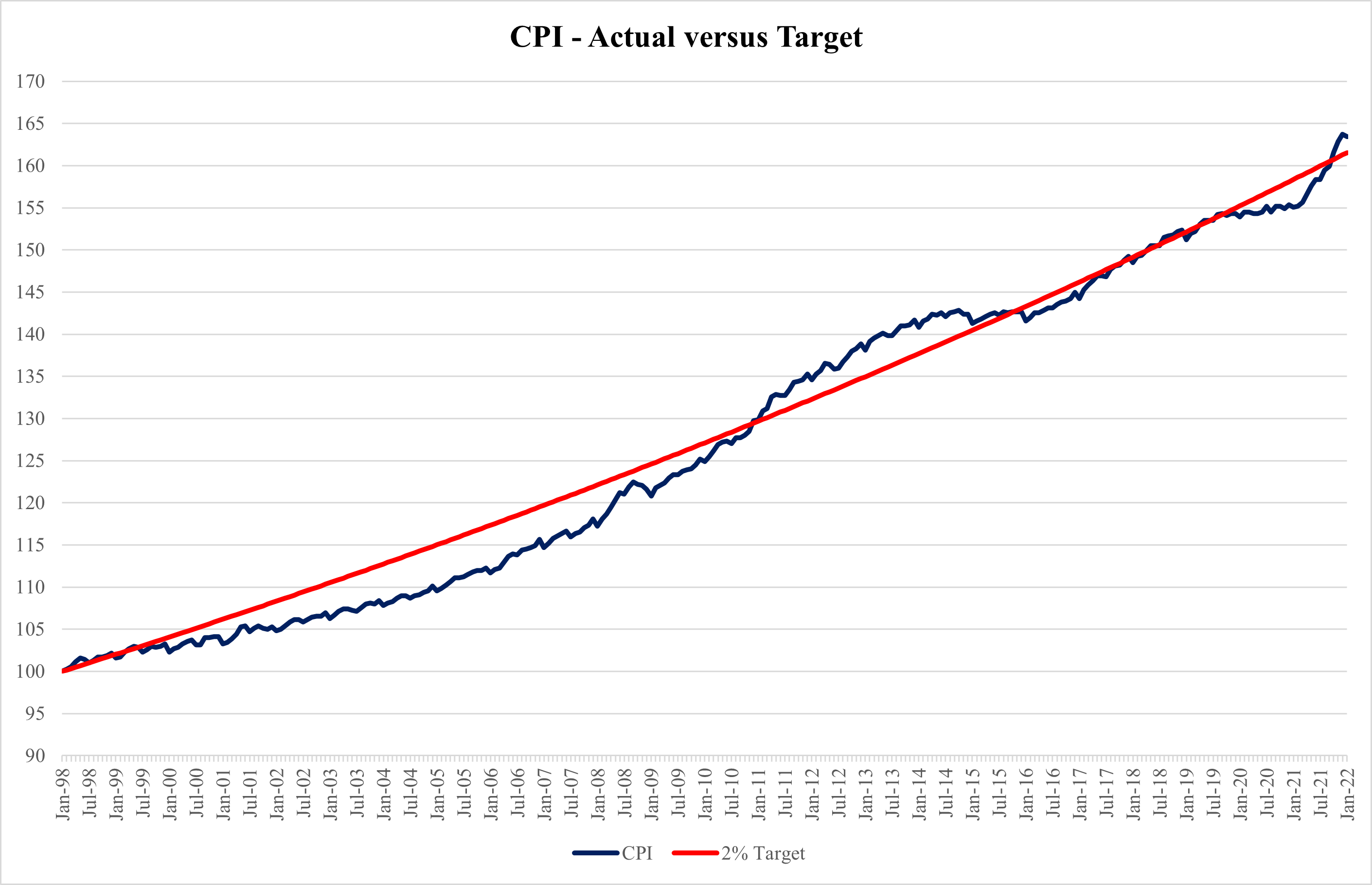

Here in the UK it was inflation again which was the highlight in terms of economic data releases. CPI came out at an eyewatering 5.5% in January, the highest reading since March 1992, above the market forecast of 5.4%. CPIH, which includes housing costs, also rose, this time by 4.9%. The largest contributors to the 12 month number were housing & household services and transport.

In the chart below we show the movement in CPI over the longer term, rebased to 100 in January 1998. For comparison we also show CPI indexed as if it were to have achieved the 2% target each year. As we can see, when indexed in this way, despite the high readings which we are currently seeing, the level of inflation is only a little over where it could have expected to have been if the inflation target had been successfully and consistently met. This of course has been helped by the low levels of inflation which we saw prior to the more recent sharp rise.

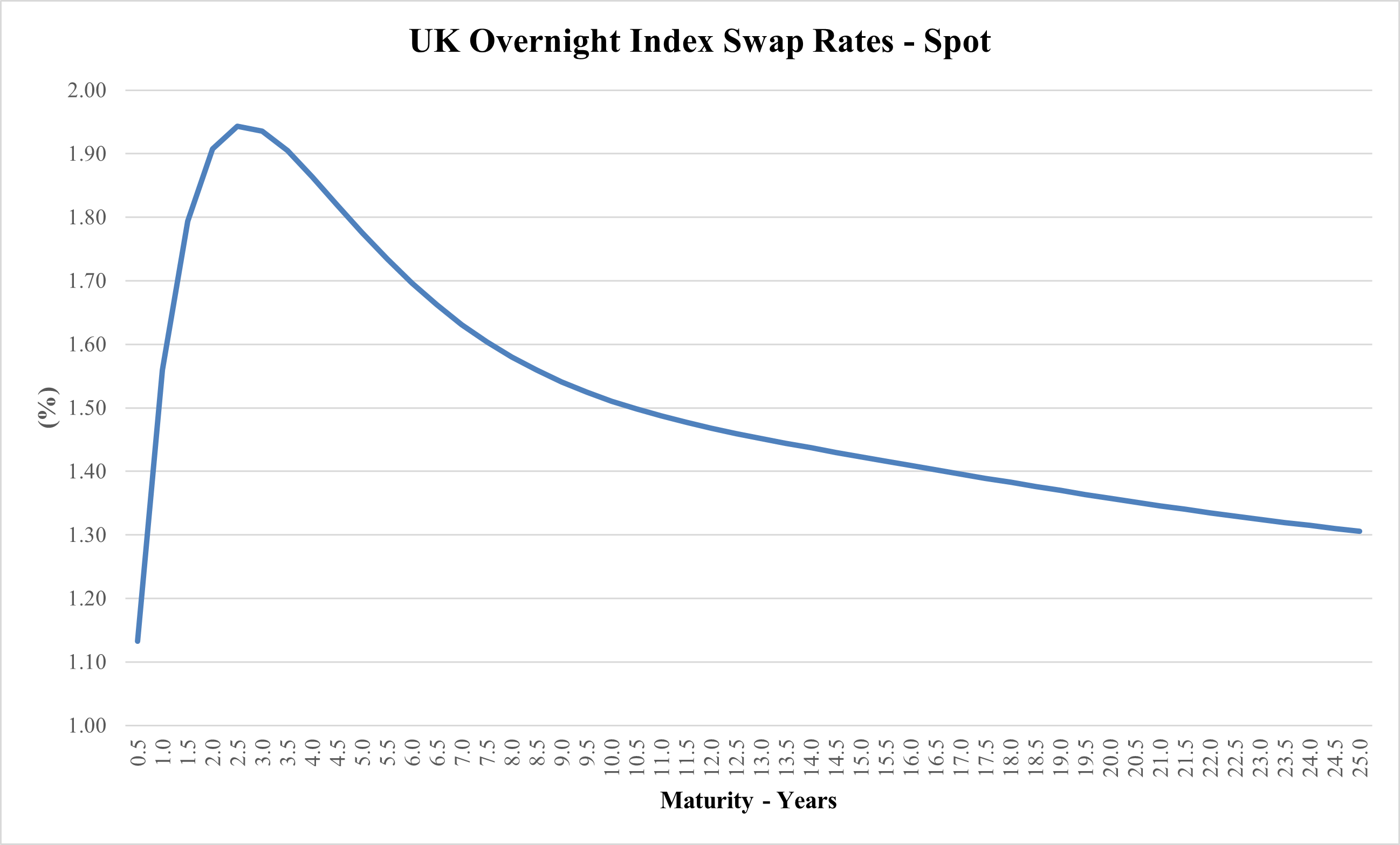

The Bank of England will be very keen for the rate of inflation to return to the 2% target over the next 2 year time horizon. Before this happens the Monetary Policy Committee (MPC) forecast that inflation will peak as high as 7% in the spring months. After this point however they forecast the inflation will return back towards the target level. They believe that this return to the 2% level will be due to the impact of higher oil and gas prices fading. They also think that the demand for goods will not continue to rise as fast and production difficulties will ease. To achieve this however the market, as reflected by overnight index swap rates, still believes that the MPC still have more interest rate hikes to deploy, on top of the rate hikes we have already seen taking us to the current level of 0.5%.

This data, although always subject to change, currently suggests that the UK base rate may need to go as high as 2% in order to suppress the inflationary forces we are currently seeing. Noticeably however, it is not expected to stay around this terminal level for long, reducing shortly afterwards. This is perhaps due to expectations, in line with the Bank of England thinking, that inflation will return to target within a 2 year period. Or, that interest rate hikes will slow the economy down.

The UK gilt yield curve also expects further interest rate rises, with a 2 year gilt yielding almost 1.4%. The long end of the yield curve however is less convinced, leading to a sharp flattening. Indeed, at the time of writing the spread between the 2 and 10 year gilt is only 0.12%.

This article is for information purposes only and should not be construed as advice. We strongly suggest you seek independent financial advice prior to taking any course of action.

The value of this investment can fall as well as rise and investors may get back less than they originally invested.

Past performance is not necessarily a guide to future performance.

The Fund is suitable for investors who are seeking to achieve long term capital growth.

The tax treatment of investments depends on the individual circumstances of each client and may be subject to change in the future. The above is in relation to a UK domiciled investor only and would be different for those domiciled outside the UK. We strongly suggest you seek independent tax advice prior to taking any course of action.

Subscribe Today

To receive exclusive fund notifications straight into your inbox, please complete this form.